Are you using automatic safety stock calculation with SAP's forecasting screen in the Material Master Record? As you might know there is a way to have the system calculate the static safety stock value (in the MRP2 screen) based on three influencing factors

1. replenishment lead time - the longer it takes to replenish, the higher the safety stock should be

2. service level - the higher the expected service level, the higher the safety stock should be (it actally grows exponentially with higher service levels)

3. consumption regularity from period to period, expressed by the mean absolute deviation or MAD

the lead time to replenish and the service level setting come from the MRP2 screen in the material master, whereas the MAD is calculated by the material forecast. The material forecast then calculates the safety stock (and a reorder level in case you are using a VM or V2 MRP type) and updates the field "safety stock" in MRP2 every time you run the forecast.

Now... if you are using this type of functionality, you can run the forecast periodically and have the system come up with safety stocks based on one specific service level setting. If yu want some automation and better visibility and results, I suggest you have a look at SAP's safety stock and reorder point simulator.

The tool is integrated with the MRP Monitor and therefore lets you select a group of materials for simulation based on criteria like consumption value, consumption consistency, length of replenishment lead time, slow / fast mover and much more. You then load these materials into the simulator in order to see the simulation results. Besides the ERP method described above, the tool calculates safety stock levels based on an advanced method that takes into consideration variability in lead time and variability in demand additionally to the three factors discussed before. You can then compare the two. But the tool also lets you simulate these two results for various service levels. If you do so you can display a regression graph that shows how the safety stock levels increase gradually with every step up in service levels. As the exponential growths kicks in the curve will become steepe and the jump in safety stock increases becomes more severe. That way you are able to pick the last good service level which produces an optimal safety stock level.

Once that is derived, you can select the optimal service level for every material and update all the material masters with safety stock, service level and reorder points. You acn also pick whether the ERP method or advanced method should be used.

A nice added value is, that you also get KPIs like "safety stock value" and "safety stock coverage in working days", which are not available in the standard.

SAP Mentor, supply chain management enthusiast. Advocate for science as a basis to optimize the SAP supply chain. Active in Europe and North America. Sailboater, private pilot, motorbiker. At home in Tribeca, NYC. The opinions expressed in this blog are mine!

Wednesday, December 18, 2013

Monday, December 16, 2013

Bridgestone sues IBM for fraud in SAP project

It is amazing to me that there are still so many failures and misguided SAP projects. Our community has been doing it for over 40 years now and there is really not much that has been changing over the years - in terms of knowing what needs to be done and what is the right thing to do in these implementations and upgrades.

Is it too much to ask a company like IBM to guide the customer in the right direction? They've done it so many times before, have developed countless methodologies, educated thousands of consultants and still... they are not able to help? It's not that IBM stands alone here. And it's not that they charge too little for whatever service they provide. And look in the article, how many more botched, failed, disastrous and fraudulent projects they conducted.

What's really frustrating is that the big companies like Bridgestone feel that they still have to retain giants like IBM, because if one of the little guys fails them, they have no one to sue. How sad is that? Isn't it time that our community provides good services to SAP customers? When does SAP start worrying about who takes on the task of making their software run? Instead of signing up unqualified, uneducated and incapable consultants with shady certifications just because they work for a giant?

If the only decision point for an SAP customer is whether or not the consultant is capable to hash out a 600 million payment resulting from a lawsuit, then we better start thinking about where this will be going?

http://spectrum.ieee.org/

Is it too much to ask a company like IBM to guide the customer in the right direction? They've done it so many times before, have developed countless methodologies, educated thousands of consultants and still... they are not able to help? It's not that IBM stands alone here. And it's not that they charge too little for whatever service they provide. And look in the article, how many more botched, failed, disastrous and fraudulent projects they conducted.

What's really frustrating is that the big companies like Bridgestone feel that they still have to retain giants like IBM, because if one of the little guys fails them, they have no one to sue. How sad is that? Isn't it time that our community provides good services to SAP customers? When does SAP start worrying about who takes on the task of making their software run? Instead of signing up unqualified, uneducated and incapable consultants with shady certifications just because they work for a giant?

If the only decision point for an SAP customer is whether or not the consultant is capable to hash out a 600 million payment resulting from a lawsuit, then we better start thinking about where this will be going?

http://spectrum.ieee.org/

Saturday, December 7, 2013

Measuring supply chain performance and how SAP software can be used to improve the rating

All too often SAP is implemented - and subsequently used - without any clear direction on what is desired to be achieved. The product is primarily acquired, mostly by senior executives to...

- solve broader reaching issues

- standardize

- renew

- make us look better, using the gold standard in IT

... and for a million other reasons. But when does anyone take the time to actually measure where you are and what was achieved with the implementation?

At bigbyte we created the Supply Chain Performance Indicator that looks at ten major measurements to benchmark how well your SAP investment drives your supply chain. Each measurement is supported by various KPIs and the final result - the SCPI or "Skippy" - visualizes the benchmark.

The ten areas of interest are:

1. Inventory Performance

- solve broader reaching issues

- standardize

- renew

- make us look better, using the gold standard in IT

... and for a million other reasons. But when does anyone take the time to actually measure where you are and what was achieved with the implementation?

At bigbyte we created the Supply Chain Performance Indicator that looks at ten major measurements to benchmark how well your SAP investment drives your supply chain. Each measurement is supported by various KPIs and the final result - the SCPI or "Skippy" - visualizes the benchmark.

The ten areas of interest are:

1. Inventory Performance

2.

Service

3.

Automation

4.

Flexibility / Agility

5.

Lean Six Sigma

6.

Cost / Profitability

7.

Visibility / Transparency

8.

Information Maturity / Basic Data

9.

Competence

10. Organizational

Support

Inventory Performance

this KPI takes a deeper look into

- Average inventory holdings

- Dead stocks and how these relate to the averages and frequency of movements

- Safety stock holdings and resulting availability and dead stock

- Inventory turns

- Categorization (slow movers, new materials, ABC, XYZ)

The measurements may be retrieved with standard SAP LIS transactions, BI (BW) or the use of the Add-On Tools “MRP Monitor” and “Inventory Cockpit”. To achieve improvements in Inventory Performance, an effort to set meaningful policy, improving forecast accuracy, better planning methods in S&OP and production, a company could raise the benchmark significantly.

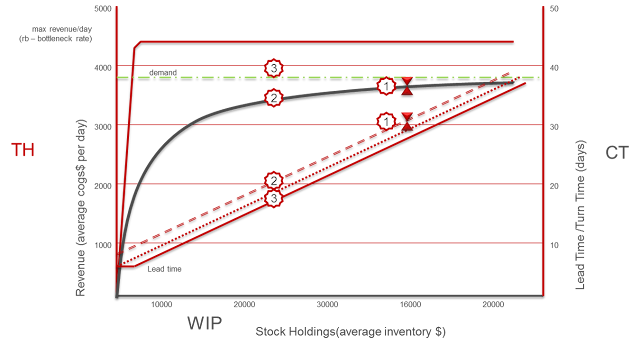

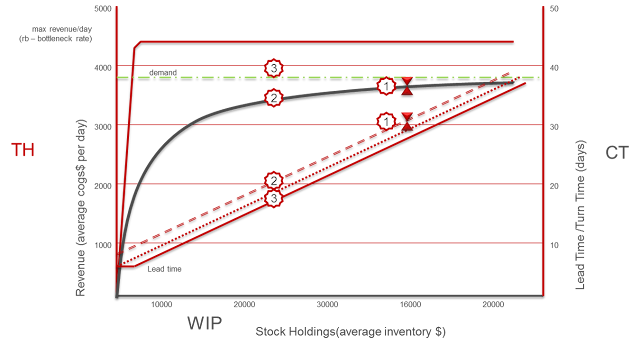

Once all reports are in we can perform ‘flow benchmarking’ and determine how well an organization is using inventory to deliver Throughput and short Cycle Times. Flow benchmarking uses Littl's Law to relate Revenue (Throughput) with average Inventory holdings (WIP) and Lead Times (or Cycle Times) and provides an excellent opportunity to calculate a third variable when two are measurable. Flow benchmarking shows how well materials flows and is an excellent tool to set a WIP cap in a pull system.

Service

Service can be measured as to how well customers receive product to their requested delivery date and how well promises are kept. But we can also measure the service level from production to the warehouse and the availability of bulk and packaging material to the packaging line. Of great importance is the consideration of a difference between a Make To Stock rating (the Fill Rate) and the Make To Order rating (Delivery Service, Delivery Ability, Delivery Reliability). The SAP Add-On 'Service Level Monitor' is an excellent tool to categorize and report on these Services.

Automation

The level of automation – using SAP functions – poses lots of improvement opportunities. Be it the automatic conversion of planned orders into a production program, automated procurement of packaging materials or the application of a method to perform regular policy setting and the resulting monitoring of exception messages, Most companies do not make enough use of standard tools available in the SAP functionality. The level of Automation could be greatly increased by implementing some of the advanced, standard functions available in the areas of Sales & Operations Planning, Materials Planning, Production scheduling and Procurement.

Flexibility / Agility

The degree of flexibility becomes apparent when looking at the way the planning (information) and material flow is designed. With the introduction of de-coupling or a inventory/order interface, and the resulting buffering of inventory before the final assembly or packaging lines, such flexibility can be achieved.

Using S&OP functionality with flexible planning of planning hierarchies and performing rough resource checks, the resulting forecast figures can be placed on an inventory point upstream from the final assembly or packaging lines. This would have the effect that the downstream lines can be scheduled with a demand driven ‘pull’ system and the resulting agility will increase service levels and drastically reduce safety stock or days of cover requirements.

The more often used method of placing an unchecked forecast on the finishing lines and the subsequent conveyance of every finished product forecast to the bulk level, leaves very little room for responsiveness to quickly changing demand. Very low flexibility to counteract forecast errors are compensated with changing the forecast of the near future. This poses a number of issues to the production scheduler and the additional problem of ever changing, “un-fixed” stock transport requisitions from the warehouse make it almost impossible to put together an agile production program.

Lean Six Sigma

A lean supply chain is defined by it’s low degree of producing or causing waste. As an example: the waste of overproducing finished goods to the warehouse can be induced by a high forecast error or a faulty transfer of demand. Additionally, ineffective planning procedures may lead to ineffective supply programs that produce lots of waste. Another form of waste lies in long cycle times. If, for example, production orders are released to the shop floor without performing all necessary steps – like an availability check for components, capacity leveling and proper sequencing of jobs – the orders remain on the line unprocessed and block valuable machine time and reserve raw or packaging material that other orders could use.

Six Sigma mostly measures defects and strives to introduce processes that will reduce the number of defects, in order to avoid waste and therefore achieve a lean supply chain with a high six sigma – or low number of defects for high quality in process and product.

A lot more effort is required to truly measure lean six sigma, but a lack of

- fitting scheduling methods

- high forecast errors

- ineffective transfer and placement of demand

- a good process to re-introduce byproduct into the process

- recipes with its possibility to perform quantity calculations and batch determination in a lean and effective way- measuring defects

- introducing a demand driven flow

lead to lots of waste and defects.

Profitability

Profitability is measured with standard FI and CO reports for Sales, Production and Procurement

Visibility / Transparency

A transparent supply chain is defined by the ability to quickly find inefficiencies and to pinpoint and find areas where exceptions occur. A good system to plan materials with policy setting and exception monitoring is conducive to a high degree of transparency.

Information Maturity / Basic Data

The basic data setup represents the most important driver of accuracy and efficiency for replenishment and planning policies. It also drives automation. Basic data includes material master, routes, work centers, resources and Bills of Material. It needs to be evaluated on a regular basis and changes must be coordinated between the various departments where it has an impact. The sum of all settings in the master (or basic) data represents a policy by which inventories and orders are filled, service levels are met and automation happens.

Very often there is a need for a concerted effort to keep master data clean, up-to-date and effective. A method needs to be put in place by which planners, schedulers and buyers will analyse, evaluate and update policies on a regular and continuous basis.

Competence

SAP usage competence is measured here. How much training for the user was received? What was the level of detail of the training? Is the system perceived to drive value? And is there user acceptance?

But we also need to measure how well general supply chain principles are understood.

Organizational Support

Further evaluations are necessary in order to determine the level of organizational support that is given to the SAP user. We consider of great importance that executives in the company, the people who made the decision to use SAP, are in full support of making the best use of the investment in SAP software. Therefore it’s of great value if the executives get involved to a fairly detailed degree and help support any improvement, sustainability and optimization projects around a better use of SAP software to drive the supply chain. This is a highly underestimated contributor to success.

Once all measurements are in, we can give an overall rating for each of the ten major KPIs and plot a spider diagram as seen below. The red line may depict the current performance, while the green line may give a target that needs to be achieved using various optimization efforts.

this KPI takes a deeper look into

- Average inventory holdings

- Dead stocks and how these relate to the averages and frequency of movements

- Safety stock holdings and resulting availability and dead stock

- Inventory turns

- Categorization (slow movers, new materials, ABC, XYZ)

The measurements may be retrieved with standard SAP LIS transactions, BI (BW) or the use of the Add-On Tools “MRP Monitor” and “Inventory Cockpit”. To achieve improvements in Inventory Performance, an effort to set meaningful policy, improving forecast accuracy, better planning methods in S&OP and production, a company could raise the benchmark significantly.

Once all reports are in we can perform ‘flow benchmarking’ and determine how well an organization is using inventory to deliver Throughput and short Cycle Times. Flow benchmarking uses Littl's Law to relate Revenue (Throughput) with average Inventory holdings (WIP) and Lead Times (or Cycle Times) and provides an excellent opportunity to calculate a third variable when two are measurable. Flow benchmarking shows how well materials flows and is an excellent tool to set a WIP cap in a pull system.

Service

Service can be measured as to how well customers receive product to their requested delivery date and how well promises are kept. But we can also measure the service level from production to the warehouse and the availability of bulk and packaging material to the packaging line. Of great importance is the consideration of a difference between a Make To Stock rating (the Fill Rate) and the Make To Order rating (Delivery Service, Delivery Ability, Delivery Reliability). The SAP Add-On 'Service Level Monitor' is an excellent tool to categorize and report on these Services.

Automation

The level of automation – using SAP functions – poses lots of improvement opportunities. Be it the automatic conversion of planned orders into a production program, automated procurement of packaging materials or the application of a method to perform regular policy setting and the resulting monitoring of exception messages, Most companies do not make enough use of standard tools available in the SAP functionality. The level of Automation could be greatly increased by implementing some of the advanced, standard functions available in the areas of Sales & Operations Planning, Materials Planning, Production scheduling and Procurement.

Flexibility / Agility

The degree of flexibility becomes apparent when looking at the way the planning (information) and material flow is designed. With the introduction of de-coupling or a inventory/order interface, and the resulting buffering of inventory before the final assembly or packaging lines, such flexibility can be achieved.

Using S&OP functionality with flexible planning of planning hierarchies and performing rough resource checks, the resulting forecast figures can be placed on an inventory point upstream from the final assembly or packaging lines. This would have the effect that the downstream lines can be scheduled with a demand driven ‘pull’ system and the resulting agility will increase service levels and drastically reduce safety stock or days of cover requirements.

The more often used method of placing an unchecked forecast on the finishing lines and the subsequent conveyance of every finished product forecast to the bulk level, leaves very little room for responsiveness to quickly changing demand. Very low flexibility to counteract forecast errors are compensated with changing the forecast of the near future. This poses a number of issues to the production scheduler and the additional problem of ever changing, “un-fixed” stock transport requisitions from the warehouse make it almost impossible to put together an agile production program.

Lean Six Sigma

A lean supply chain is defined by it’s low degree of producing or causing waste. As an example: the waste of overproducing finished goods to the warehouse can be induced by a high forecast error or a faulty transfer of demand. Additionally, ineffective planning procedures may lead to ineffective supply programs that produce lots of waste. Another form of waste lies in long cycle times. If, for example, production orders are released to the shop floor without performing all necessary steps – like an availability check for components, capacity leveling and proper sequencing of jobs – the orders remain on the line unprocessed and block valuable machine time and reserve raw or packaging material that other orders could use.

Six Sigma mostly measures defects and strives to introduce processes that will reduce the number of defects, in order to avoid waste and therefore achieve a lean supply chain with a high six sigma – or low number of defects for high quality in process and product.

A lot more effort is required to truly measure lean six sigma, but a lack of

- fitting scheduling methods

- high forecast errors

- ineffective transfer and placement of demand

- a good process to re-introduce byproduct into the process

- recipes with its possibility to perform quantity calculations and batch determination in a lean and effective way- measuring defects

- introducing a demand driven flow

lead to lots of waste and defects.

Profitability

Profitability is measured with standard FI and CO reports for Sales, Production and Procurement

Visibility / Transparency

A transparent supply chain is defined by the ability to quickly find inefficiencies and to pinpoint and find areas where exceptions occur. A good system to plan materials with policy setting and exception monitoring is conducive to a high degree of transparency.

Information Maturity / Basic Data

The basic data setup represents the most important driver of accuracy and efficiency for replenishment and planning policies. It also drives automation. Basic data includes material master, routes, work centers, resources and Bills of Material. It needs to be evaluated on a regular basis and changes must be coordinated between the various departments where it has an impact. The sum of all settings in the master (or basic) data represents a policy by which inventories and orders are filled, service levels are met and automation happens.

Very often there is a need for a concerted effort to keep master data clean, up-to-date and effective. A method needs to be put in place by which planners, schedulers and buyers will analyse, evaluate and update policies on a regular and continuous basis.

Competence

SAP usage competence is measured here. How much training for the user was received? What was the level of detail of the training? Is the system perceived to drive value? And is there user acceptance?

But we also need to measure how well general supply chain principles are understood.

Organizational Support

Further evaluations are necessary in order to determine the level of organizational support that is given to the SAP user. We consider of great importance that executives in the company, the people who made the decision to use SAP, are in full support of making the best use of the investment in SAP software. Therefore it’s of great value if the executives get involved to a fairly detailed degree and help support any improvement, sustainability and optimization projects around a better use of SAP software to drive the supply chain. This is a highly underestimated contributor to success.

Once all measurements are in, we can give an overall rating for each of the ten major KPIs and plot a spider diagram as seen below. The red line may depict the current performance, while the green line may give a target that needs to be achieved using various optimization efforts.

some of the optimization efforts that may drive your SAP supply chain towards your perceived targets can be:

- managing inventories using policies and exception monitoring

- optimizing availability checks and transfer of demand

- automating replenishment and procurement

- using better production / capacity scheduling methods

- introducing a system for materials planning & policy setting

- maintaining a usable KPI framework and reporting tools

- performing optimized S&OP and forecasting / rough resource checks

- using more integrated, standard SAP functionality for delivery and distribution

The ratings might not perfectly represent the actual situation - it is an approximation - but it's still so much better that moving in the dark and trying to find that magic handrail to guide you in the, hopefully, right direction.

- managing inventories using policies and exception monitoring

- optimizing availability checks and transfer of demand

- automating replenishment and procurement

- using better production / capacity scheduling methods

- introducing a system for materials planning & policy setting

- maintaining a usable KPI framework and reporting tools

- performing optimized S&OP and forecasting / rough resource checks

- using more integrated, standard SAP functionality for delivery and distribution

The ratings might not perfectly represent the actual situation - it is an approximation - but it's still so much better that moving in the dark and trying to find that magic handrail to guide you in the, hopefully, right direction.

Sunday, December 1, 2013

Batch Expiration in MRP

I've come across the problem of batch expiration many times. It is typical for Life Sciences, Consumer Products, Food and Beverage Companies to Batch Manage and Shelf Life manage their materials and products.

During Material Requirements Planning or Master Production Scheduling (both Standard and Long-Term Planning), SAP R/3 does not discount the net available batch quantities that are expiring out into the future (and instead considers them as available depending on the Inventory Stock categories configured for the checking rule for MRP). This is a big gap.

Then I saw a solution brief from Vija Pisipaty (IT Sapiens) which addresses the problem in an add-on tool (without any source code modification) with the following features to overcome the gap:

The functionality caters to Unrestricted Stock, Customer Stock, Vendor Consignment Stock and Subcontractor Stock. The solution can also be extended to project Stock. I really like this solution and wanted to spread the word about it, since it represents a big problem for anyone managing batches and planning these in SAP.

Saturday, November 23, 2013

some thoughts about lot sizing and what it could mean to production scheduling...

generally speaking, you want to keep the supply chain agile and flexible... and very often I try to convince my clients to do that with a fixed lot size. Now the term might be misleading (because it can convey the notion that the lot size will be fixed - when it actually won't be) but let me explain my thinking:In the SAP supply chain, the MRP run does not schedule a production program. MRP simply meets demand with supply (driven by the lot size procedure) that is placed just at the date when the demand occurs. It does so without consideration of any resource constraints, So it is necessary to introduce another step to level, sequence and distribute production quantities in a way that they fit into available capacity and produce great service levels with the least possible inventory.If you use a periodic lot size procedure, MRP will generate a planned order that meets the total demand of that period. You can then no more split and distribute these quantities within that period (obviously a monthly lot size is worse in that respect than a weekly is).My thinking behind using a fixed lot size is to generate many supply proposals (planned orders) in the least, feasible production lot, all sitting on top of each other on the demand date. If, for example, you have a weekly demand from a forecast of 10,000 pounds, you would get one planned order with 10,000 pounds sitting for delivery on Monday morning should you use a weekly lot size. But if you use a fixed lot size of 1,000 pounds (if that is the least, feasible quantity), you have now ten planned orders which you can distribute into the previous week. You can still make the entire lot of 10,000 on Friday afternoon, but now you do have the option to make 2,000 every day of the week or 5,000 on Tuesday and 5,000 on Thursday or... you get the idea!what I see often forgotten, is that there is the need for that extra step of 'production scheduling'. Many people just take as a production program what's generated by MRP and that can cause you many problems in the factory - especially for MTS and it's associated mixed model scheduling with MTO

Wednesday, November 20, 2013

the importance of the 'Stock Transport Order fix"

as I am spending an awesome time in Australia, I am coming across a very old issue. An issue which is making the production scheduler's job so difficult in so many companies: the lack of a process that fixes Stock Transport Order Requisitions and leaves them unavailable for the MRP run to change any day.

Here is what I'm talking about: very often SAP is setup to support a distribution network where DCs carry a forecast and the resulting demand is transferred to the manufacturing plant via a stock transport order requisition. The STO req becomes a demand in the supplying (manufacturing) plant and the MRP run generates supply in form of planned orders.

so far so good because everybody thinks that when the manufacturing plant just sends out the requested quantities at the time it was requested, we are all good. and then the DC never gets the right quantity at the right time! And everybody questions the production scheduler: "you knew way ahead of time... why didn't you deliver?"

Here is what I think is not working: ... but first a picture of the beautiful outback

It should be clear that inventory responsibility must remain with the place where the forecast resides. That usually is the DC, because that is the place where the sales orders come in as well. And those sales orders are looking for forecasts that they can consume. What happens when sales orders consume forecasts is a netting of inventory. That means that when the sales orders exceed the forecast, the system thinks to brin more in from the manufacturing plant. In revers, when the forecast exceeds what customers actually pick up, MRP will say "stop bringing in more - we have enough".

The latter is a big problem for anyone who received an order to produce weeks or months ago. Because they were told to make 5,000 lbs a long time ago. They bought raw materials, packaging goods and filled the lines accordingly. Now the DC says stop? I don't want it anymore? because the customers changed their mind?

Who's responsibility is it? I believe whoever puts the forecast together must take the inventory. And if the forecast was wrong - as it always is - someone has to take the hit. If you think that it is the production line that has to adjust, then we have a very big difference of opinion. In my mind the production line (the scheduler) has the task to produce to demand as efficient as possible. The DC's (material planner) responsibility is to anticipate MTS demand as close as possible and to deal with deviations using stock policies and replenishment strategies to gain good service levels.

So to make a long story short: if we agree that inventory responsibility remains in the DC, then we will have to convert stock transport order requisitions for at least the replenishment lead time out. Because if you don't, the MRP run will change quantities and dates according to the way customers pick up. And that is definitely a shift of inventory responsibility from the DC to the manufacturing plant.

I'd love to hear your opinion on this as it seems to be a widespread misunderstanding and point of contention.

Here is what I'm talking about: very often SAP is setup to support a distribution network where DCs carry a forecast and the resulting demand is transferred to the manufacturing plant via a stock transport order requisition. The STO req becomes a demand in the supplying (manufacturing) plant and the MRP run generates supply in form of planned orders.

so far so good because everybody thinks that when the manufacturing plant just sends out the requested quantities at the time it was requested, we are all good. and then the DC never gets the right quantity at the right time! And everybody questions the production scheduler: "you knew way ahead of time... why didn't you deliver?"

Here is what I think is not working: ... but first a picture of the beautiful outback

It should be clear that inventory responsibility must remain with the place where the forecast resides. That usually is the DC, because that is the place where the sales orders come in as well. And those sales orders are looking for forecasts that they can consume. What happens when sales orders consume forecasts is a netting of inventory. That means that when the sales orders exceed the forecast, the system thinks to brin more in from the manufacturing plant. In revers, when the forecast exceeds what customers actually pick up, MRP will say "stop bringing in more - we have enough".

The latter is a big problem for anyone who received an order to produce weeks or months ago. Because they were told to make 5,000 lbs a long time ago. They bought raw materials, packaging goods and filled the lines accordingly. Now the DC says stop? I don't want it anymore? because the customers changed their mind?

Who's responsibility is it? I believe whoever puts the forecast together must take the inventory. And if the forecast was wrong - as it always is - someone has to take the hit. If you think that it is the production line that has to adjust, then we have a very big difference of opinion. In my mind the production line (the scheduler) has the task to produce to demand as efficient as possible. The DC's (material planner) responsibility is to anticipate MTS demand as close as possible and to deal with deviations using stock policies and replenishment strategies to gain good service levels.

So to make a long story short: if we agree that inventory responsibility remains in the DC, then we will have to convert stock transport order requisitions for at least the replenishment lead time out. Because if you don't, the MRP run will change quantities and dates according to the way customers pick up. And that is definitely a shift of inventory responsibility from the DC to the manufacturing plant.

I'd love to hear your opinion on this as it seems to be a widespread misunderstanding and point of contention.

Tuesday, November 12, 2013

Mastering supply chain Management with SAP - 10 year anniversary conference in Melbourne, Australia

The Eventful Group invited me to speak at their Mastering SAP supply chain Conference in Melbourne, Australia. It's a wonderful event with great presentations, networking sessions, workshops and a really fun time "down under".

After a very long flight, I arrived at the Crown Hotels in downtown Melbourne on Saturday afternoon. A quick shower, some food and off I went to explore the city. The event was hosted at the Crown Promenade, which is adjacent to the river bank and an array of great shops, restaurants and many things to do and see. It's my first time in Australia so I was very excited to venture out and engage with the culture that I read and heard so many positive things about. And I wasn't disappointed at all.

But the jet lag kicked in early and I decided to rest, so it wouldn't be too grueling to catch up to the timezone that's 16 hours removed from the one at home.

On Sunday the event got kicked off with a supply chain workshop that was hosted and run by UXC Oxygen, a premier SAP consulting company for Australia and New Zealand. Paul Sipos did a fantastic job to guide and connect us through various presentations, discussions and explorations, held by Oxygen experts, about functionality to support the supply chain - in ERP as well as APO. Lots of valuable information and informative discussions by a 30 people audience.

Monday then the main event. A keynote presentation by Mark Vollrath of Colgate Palmolive that dealt with the importance of setting a supply chain strategy. All other presentations were divided into three tracks: Innovation, Fundamentals and People. Of special note on day 1 are John Fatkin's "19Signs that Your Project's Change Management is in Danger", Pascal Renet adding a very nice presentation around Transportation Management and how it brings upon "Real, Real-Time supply chain Reality", and Simon Vincent with great insights on "The Importance of Building Alignment and Trust into Strategy and Execution".

At night, a wonderful reception where besides the Karaoke performances, the outstanding networking opportunities do deserve special mention. oh... and what about 170 drums?

Day two was kicked off with a very interesting slide show and presentation by Daniel Cameron on "Laser Focused Procurement". A number of memorable slides showing the Goldman Sachs Building in Lower Manhattan fully lit, during the 'blackout' after devastating Hurricane Sandy hit the region in 2012, grabbed my attention.

Marek Kowalkiewicz, a fellow SAP Mentor from SAP Singapore, then revealed some "Super Secret SCM Innovation Stories". Marek put special focus on SAP's strides on Design Thinking which I find extremely interesting. We even had a session on "Right Brain Competencies on Demand", beautifully led by Silvia Demiano.

But there were many other great presentation and I am sorry that I can not mention them all. I wish I could have attended more of the excellent speeches and demonstrations, but I was busy with three of them myself: "Effective Materials Planning", "Alignment between Sales and Production" and "Effective Production Scheduling Methods" were my titles, which I plan to re-record and make available on this blog.

Another great, fun, very informative conference by The Eventful Group, led by a team of very professional and heartwarming organizers... headed up by the wonderful Sophie Sipsma.

After a very long flight, I arrived at the Crown Hotels in downtown Melbourne on Saturday afternoon. A quick shower, some food and off I went to explore the city. The event was hosted at the Crown Promenade, which is adjacent to the river bank and an array of great shops, restaurants and many things to do and see. It's my first time in Australia so I was very excited to venture out and engage with the culture that I read and heard so many positive things about. And I wasn't disappointed at all.

But the jet lag kicked in early and I decided to rest, so it wouldn't be too grueling to catch up to the timezone that's 16 hours removed from the one at home.

On Sunday the event got kicked off with a supply chain workshop that was hosted and run by UXC Oxygen, a premier SAP consulting company for Australia and New Zealand. Paul Sipos did a fantastic job to guide and connect us through various presentations, discussions and explorations, held by Oxygen experts, about functionality to support the supply chain - in ERP as well as APO. Lots of valuable information and informative discussions by a 30 people audience.

Monday then the main event. A keynote presentation by Mark Vollrath of Colgate Palmolive that dealt with the importance of setting a supply chain strategy. All other presentations were divided into three tracks: Innovation, Fundamentals and People. Of special note on day 1 are John Fatkin's "19Signs that Your Project's Change Management is in Danger", Pascal Renet adding a very nice presentation around Transportation Management and how it brings upon "Real, Real-Time supply chain Reality", and Simon Vincent with great insights on "The Importance of Building Alignment and Trust into Strategy and Execution".

At night, a wonderful reception where besides the Karaoke performances, the outstanding networking opportunities do deserve special mention. oh... and what about 170 drums?

Day two was kicked off with a very interesting slide show and presentation by Daniel Cameron on "Laser Focused Procurement". A number of memorable slides showing the Goldman Sachs Building in Lower Manhattan fully lit, during the 'blackout' after devastating Hurricane Sandy hit the region in 2012, grabbed my attention.

Marek Kowalkiewicz, a fellow SAP Mentor from SAP Singapore, then revealed some "Super Secret SCM Innovation Stories". Marek put special focus on SAP's strides on Design Thinking which I find extremely interesting. We even had a session on "Right Brain Competencies on Demand", beautifully led by Silvia Demiano.

But there were many other great presentation and I am sorry that I can not mention them all. I wish I could have attended more of the excellent speeches and demonstrations, but I was busy with three of them myself: "Effective Materials Planning", "Alignment between Sales and Production" and "Effective Production Scheduling Methods" were my titles, which I plan to re-record and make available on this blog.

Another great, fun, very informative conference by The Eventful Group, led by a team of very professional and heartwarming organizers... headed up by the wonderful Sophie Sipsma.

Thursday, November 7, 2013

Trip report: going to Melbourne as a top tier frequent flyer on United Airlines

When I was invited by the wonderful people from The Eventful Group to speak at their "Mastering SAP supply chain" conference in Melbourne Australia, I was really excited and looking forward to the trip. As it turned out, United Airlines was quick to make sure they put a big damper on my happiness. After all, I fly between 100 and 130k with them... Year by year, mile by mile... for the last 21 years (oops... you think you could expect a little service..,

So...right after The Eventful Group confirmed, I called United to book the flight. I call because I have 6 global upgrades and if you book online you can't use them (you figure out why that is). The rep on the phone gave me the run-around "you can't use an upgrade in that fare class... No, not that day... Uh, not on Australian flights... Maybe later... Maybe earlier".

Ok! I understand, United. You don't want to give away biz class flights to Australia for an economy fare, but then say so. And don't make me book every flight of the year on United with the promise that I get 6 upgrades of which I want to use at least two on the ONE flight that means the most to me - 25 hours in coach? After I spend money on you at least twice a week for the whole year?

Ok... I'm booked... Standby for business first. Which means that in case they don't sell the seats, then they will put me on a waitlist which they prioritize by... 'god only knows how'

A little while later I think about my visa. United tells me they can do it for me... Ok, no need to go online where it's free. I can call a United rep and they do it for me. 75 minutes later I've been told that I have a visa for Australia... for a $60 charge. Unfortunately the Visa isn't there when I check in at the airport. Not only that... But the check-in rep gives me a scolding about why I don't take charge and book my Visa online... "Because I trust United provides me with that service... As promised... For a 1K passsenger... For $60? She gives me that look that makes me feel like I'm a crazy man.

So I thank her for getting me a Visa and spending another $60 and get a 'roll of the eyes' in return. (I wonder how they treat in-frequent flyers).

On to LAX. 5 hours and 35 minutes in flight. I feel like that's enough for today but no dice... the big one is coming up next. At LAX I check on the waitlist for upgrades and I find myself as number 10. Briefly wondering how a 1K, who uses a complementary global upgrade (we get 6 of those a year and usually I have at least 5 of those expire at the end of the year), can be displaced by 9 other travelers (this is not a regular complimentary upgrade I am asking for - it's a global upgrade certificate) I check on the last segment from SYD to MEL. I am not even on the list !

So I go to speak to an agent... "Call the help desk". I do and I ask why I'm not on the list. The phone agent: "Do you want to talk to IT?" I say "No, I want to get on the list"... I hear a click, background music comes on and then I get disconnected. Again: how do they treat their in-frequent flyers?

Now I am boarding for the flight to Sydney. Seat assignment is 19C - bulkhead with extra air conditioning blowing the life out of me. The lady in the middle seat next to me is wrapped up in her and my blanket and a fleece jacket. She's not one of these skinny supermodels, so she takes up about 45% of the three seat... about 27.5% left for me. The airplane must be from the '70s. THEY STILL HAVE SHARED SCREENS FOR THE MOVIES !!! So there are 3 movies "Grown ups", "The Heat", "Planes" and a comedy collection available. They play that over and over for 15 hours. I pop some Melatonin and hope to be able to sleep.

Now comes the food... I really don't want to talk about it. It makes me sick... I didn't eat for the entire flight.

Meanwhile I take a jealous glance at Business First... that makes me feel much better. They have configurations of two and four seats. the seats come down flat - which is great for sleeping on your back - but they seem to be as wide as economy... not one inch wider. If you are in the middle of those four seaters, you must be feeling very similar to what I'm going through... and that for $18,500? Well you've got your own private screen!

It's Saturday morning and we land in beautiful Australia. Surprisingly, I feel ok. Slept about 7 hours, but I am really hungry. It seems that the UA Aussie staff is a lot more friendly. The get me into the New Zealand Air lounge and I get a very good breakfast. Then I stop by the desk to see if I can get an upgrade for the last leg. "No worries, mate" the agent replies, "there are 30 open seats in Business First. Please have a seat. I will look you up". It's only an hour and a half, but I don't mind using my upgrade certificate because it will expire anyway... along with 5 other ones.

there comes the lovely agent "We are so sorry Sir, but United does not allow you to be upgraded. They claim that the agents in LAX should have put you on the list in LA. Once you boarded the plane it's all done". I reply "but I was put on the list six weeks ago when I booked the flight?" "We are so sorry but they scolded us already!"

So the Aussies got scolded for trying to get a 1K his upgrade for the certificate that he deserved for flying 130,000 miles last year. No worries, mates! I sit in economy staring at Business First with 2 passengers and the flight attendants stretching out on those empty seats because they have no one to serve. Nice!

Now that it is all done I know that my life with United is coming to an end. And I am thinking about what was the best and what was the worst. That assessment is easy: the best was when it was still Continental! The worst? It's that feeling when you get off the phone with United or walk away from their check-in booth. It's that feeling of "I must have done something wrong... I must be a bad person" that you get when you talk to them... Is that what "flying the friendly United skies" is all about?

Next year I will be a 1K again. I will receive those upgrade certificates again and I will use them when I can confirm the upgrade before the flight... without waitlist... as if that will happen? Other than that I will shop around for business class flights on long hauls and if I can give one suggestion as a frequent flyer: It is not worth buying every flight on United just to get a Premier Status. What's in it for me? absolutely nothing. I am much better off to buy a business class ticket on another airline for a better price.

...and the prioritization of that waiting list? I guarantee, that they give it to less frequent flyers who they want to entice to join and hook. Once you're hooked and fly the "friendly skies" all the times, they will treat you like they treat me... and that's not pretty...

So...right after The Eventful Group confirmed, I called United to book the flight. I call because I have 6 global upgrades and if you book online you can't use them (you figure out why that is). The rep on the phone gave me the run-around "you can't use an upgrade in that fare class... No, not that day... Uh, not on Australian flights... Maybe later... Maybe earlier".

Ok! I understand, United. You don't want to give away biz class flights to Australia for an economy fare, but then say so. And don't make me book every flight of the year on United with the promise that I get 6 upgrades of which I want to use at least two on the ONE flight that means the most to me - 25 hours in coach? After I spend money on you at least twice a week for the whole year?

Ok... I'm booked... Standby for business first. Which means that in case they don't sell the seats, then they will put me on a waitlist which they prioritize by... 'god only knows how'

A little while later I think about my visa. United tells me they can do it for me... Ok, no need to go online where it's free. I can call a United rep and they do it for me. 75 minutes later I've been told that I have a visa for Australia... for a $60 charge. Unfortunately the Visa isn't there when I check in at the airport. Not only that... But the check-in rep gives me a scolding about why I don't take charge and book my Visa online... "Because I trust United provides me with that service... As promised... For a 1K passsenger... For $60? She gives me that look that makes me feel like I'm a crazy man.

So I thank her for getting me a Visa and spending another $60 and get a 'roll of the eyes' in return. (I wonder how they treat in-frequent flyers).

On to LAX. 5 hours and 35 minutes in flight. I feel like that's enough for today but no dice... the big one is coming up next. At LAX I check on the waitlist for upgrades and I find myself as number 10. Briefly wondering how a 1K, who uses a complementary global upgrade (we get 6 of those a year and usually I have at least 5 of those expire at the end of the year), can be displaced by 9 other travelers (this is not a regular complimentary upgrade I am asking for - it's a global upgrade certificate) I check on the last segment from SYD to MEL. I am not even on the list !

So I go to speak to an agent... "Call the help desk". I do and I ask why I'm not on the list. The phone agent: "Do you want to talk to IT?" I say "No, I want to get on the list"... I hear a click, background music comes on and then I get disconnected. Again: how do they treat their in-frequent flyers?

Now I am boarding for the flight to Sydney. Seat assignment is 19C - bulkhead with extra air conditioning blowing the life out of me. The lady in the middle seat next to me is wrapped up in her and my blanket and a fleece jacket. She's not one of these skinny supermodels, so she takes up about 45% of the three seat... about 27.5% left for me. The airplane must be from the '70s. THEY STILL HAVE SHARED SCREENS FOR THE MOVIES !!! So there are 3 movies "Grown ups", "The Heat", "Planes" and a comedy collection available. They play that over and over for 15 hours. I pop some Melatonin and hope to be able to sleep.

Now comes the food... I really don't want to talk about it. It makes me sick... I didn't eat for the entire flight.

Meanwhile I take a jealous glance at Business First... that makes me feel much better. They have configurations of two and four seats. the seats come down flat - which is great for sleeping on your back - but they seem to be as wide as economy... not one inch wider. If you are in the middle of those four seaters, you must be feeling very similar to what I'm going through... and that for $18,500? Well you've got your own private screen!

It's Saturday morning and we land in beautiful Australia. Surprisingly, I feel ok. Slept about 7 hours, but I am really hungry. It seems that the UA Aussie staff is a lot more friendly. The get me into the New Zealand Air lounge and I get a very good breakfast. Then I stop by the desk to see if I can get an upgrade for the last leg. "No worries, mate" the agent replies, "there are 30 open seats in Business First. Please have a seat. I will look you up". It's only an hour and a half, but I don't mind using my upgrade certificate because it will expire anyway... along with 5 other ones.

there comes the lovely agent "We are so sorry Sir, but United does not allow you to be upgraded. They claim that the agents in LAX should have put you on the list in LA. Once you boarded the plane it's all done". I reply "but I was put on the list six weeks ago when I booked the flight?" "We are so sorry but they scolded us already!"

So the Aussies got scolded for trying to get a 1K his upgrade for the certificate that he deserved for flying 130,000 miles last year. No worries, mates! I sit in economy staring at Business First with 2 passengers and the flight attendants stretching out on those empty seats because they have no one to serve. Nice!

Now that it is all done I know that my life with United is coming to an end. And I am thinking about what was the best and what was the worst. That assessment is easy: the best was when it was still Continental! The worst? It's that feeling when you get off the phone with United or walk away from their check-in booth. It's that feeling of "I must have done something wrong... I must be a bad person" that you get when you talk to them... Is that what "flying the friendly United skies" is all about?

Next year I will be a 1K again. I will receive those upgrade certificates again and I will use them when I can confirm the upgrade before the flight... without waitlist... as if that will happen? Other than that I will shop around for business class flights on long hauls and if I can give one suggestion as a frequent flyer: It is not worth buying every flight on United just to get a Premier Status. What's in it for me? absolutely nothing. I am much better off to buy a business class ticket on another airline for a better price.

...and the prioritization of that waiting list? I guarantee, that they give it to less frequent flyers who they want to entice to join and hook. Once you're hooked and fly the "friendly skies" all the times, they will treat you like they treat me... and that's not pretty...

Tuesday, November 5, 2013

Does the forecast HAVE to end up on the finished product?

All too often I see companies using strategy 40 for the finished product and then the forecast ends up as a VSF in every FERT's MD04 and the demand for all lower level BoM items comes from the finished goods. I find this a rather ineffective, cumbersome and downright costly way of planning... especially in the Process Industries where there's a V shaped BoM structure (much more finished product's variety than there are raw materials).

We all know that the forecast is always wrong. So if you forecast 10 liter bottles separately from 5 liter bottles that contain the same liquid, you are exponentially compounding that error when you hand it through to the bulk level.

How about forecasting and pre-manufacturing the liquid (bulk) to inventory and filling it into the bottle as the customer is asking for it?

I am aware that this sounds too easy and isn't practical everywhere. At least you can think about it and take another point of view. Who knows... It might make a big positive difference and may be worth a try

We all know that the forecast is always wrong. So if you forecast 10 liter bottles separately from 5 liter bottles that contain the same liquid, you are exponentially compounding that error when you hand it through to the bulk level.

How about forecasting and pre-manufacturing the liquid (bulk) to inventory and filling it into the bottle as the customer is asking for it?

I am aware that this sounds too easy and isn't practical everywhere. At least you can think about it and take another point of view. Who knows... It might make a big positive difference and may be worth a try

Friday, October 25, 2013

Options to buffer variability in your SAP software. Picking the right combination of buffers helps with service levels and optimized inventories.

Factory Physics by Spearman and Hopp describes how three buffers develop when variability exists: Inventory, Time and Capacity. The art of effective materials planning lies in designing the optimum mix of these three buffers and setting policy accordingly. This blog post talks to the buffering options you have in SAP.

First there is the inventory buffer. It's usually called the safety stock. In SAP you can simply set an estimated amount of inventory that you want to keep aside for when you need more than expected. MRP ignores that stock but the Availability Check can use it in times of over consumption. You can estimate and set the amount in the field Safety Stock on MRP2, but you can also use the forecast module to calculate and update it periodically. As the automatic calculation considers past consumption patterns, long or short lead times and the service level you desire, this is a great way to adjust the safety holdings to an ever changing situation. Then there is the dynamic safety stock driven by the Range Of Coverage profile - also maintained on the MRP2 screen. You can customize various coverage profiles and set a minimum, a target and a maximum coverage in days. The system will then calculate the future, average, daily demand and multiply that figure with the target coverage set in the Range of Coverge profile. The result is a dynamic safety stock that goes up and down with how your average, future, daily demand goes up and down. The RoC profile has the added advantage that yu can set a maximum (dynamic) stock level, which keeps your inventory below a celing should your forecast exceed the actual demand.

As for the time buffer you have some options too. Safety Time on MRP2 allows you to move the requirement, for planning purposes, back in time. As an example: if you set 2 days of safety time and you have a requirement to be fulfilled on September 28, MRP will plan to get that stuff on September 26. But the biggest impact on your time buffer has the decision on MTO versus MTS (driven by the strategy group on MRP3 primarily). Simply speaking: if your customers want to pick the product up right away, you have to plan it using a Make To Stock strategy, so that there is product readily available, produced to a forecast (full use of the inventory buffer). However, if your customers accept a lead time (if they don't and it's not economical for you to produce to a forecast then you shouldn't offer that product in the first place or change your business process so that it feasibly supports MTS production), one can employ a Make To Order strategy. Now the question is: "how long of a lead time does the customer accept?" Once you have the answer you can move the Inventory / Order interface (discussed in previous blog posts of mine) to adjust the lead time to the customer. The I/O interface is that point in your value stream where upstream of it you make to stock and downstream of it the customer "pulls" in a Make to Order fashion. The further downstream the I/O interface is, the shorter the time buffer and you set it in the field "Total replenishment Lead Time" in the MRP3 screen, right next to the field "Availability Check" (and that proximity is certainly not a coincidence).

The capacity buffer enables you to counter variability (line down, forecast error, supplier delivery delayed, rush orders etc.) with additional working hours or machine availability. The most effective use of the capacity buffer is given when you do not schedule your production lines to 100% (I have seen many times that lines are scheduled to be utilized 120%). Leaving free available capacity in the schedule, enables MTO orders to drop in and enables a relative short fulfillment of unplanned order quantities.

The best combination of the three buffers also fulfills the demand for a lean and agile supply chain. The MTS part therin provides the lean part in that it reduces waste whereas MTO gives you a lot of agility.

First there is the inventory buffer. It's usually called the safety stock. In SAP you can simply set an estimated amount of inventory that you want to keep aside for when you need more than expected. MRP ignores that stock but the Availability Check can use it in times of over consumption. You can estimate and set the amount in the field Safety Stock on MRP2, but you can also use the forecast module to calculate and update it periodically. As the automatic calculation considers past consumption patterns, long or short lead times and the service level you desire, this is a great way to adjust the safety holdings to an ever changing situation. Then there is the dynamic safety stock driven by the Range Of Coverage profile - also maintained on the MRP2 screen. You can customize various coverage profiles and set a minimum, a target and a maximum coverage in days. The system will then calculate the future, average, daily demand and multiply that figure with the target coverage set in the Range of Coverge profile. The result is a dynamic safety stock that goes up and down with how your average, future, daily demand goes up and down. The RoC profile has the added advantage that yu can set a maximum (dynamic) stock level, which keeps your inventory below a celing should your forecast exceed the actual demand.

As for the time buffer you have some options too. Safety Time on MRP2 allows you to move the requirement, for planning purposes, back in time. As an example: if you set 2 days of safety time and you have a requirement to be fulfilled on September 28, MRP will plan to get that stuff on September 26. But the biggest impact on your time buffer has the decision on MTO versus MTS (driven by the strategy group on MRP3 primarily). Simply speaking: if your customers want to pick the product up right away, you have to plan it using a Make To Stock strategy, so that there is product readily available, produced to a forecast (full use of the inventory buffer). However, if your customers accept a lead time (if they don't and it's not economical for you to produce to a forecast then you shouldn't offer that product in the first place or change your business process so that it feasibly supports MTS production), one can employ a Make To Order strategy. Now the question is: "how long of a lead time does the customer accept?" Once you have the answer you can move the Inventory / Order interface (discussed in previous blog posts of mine) to adjust the lead time to the customer. The I/O interface is that point in your value stream where upstream of it you make to stock and downstream of it the customer "pulls" in a Make to Order fashion. The further downstream the I/O interface is, the shorter the time buffer and you set it in the field "Total replenishment Lead Time" in the MRP3 screen, right next to the field "Availability Check" (and that proximity is certainly not a coincidence).

The capacity buffer enables you to counter variability (line down, forecast error, supplier delivery delayed, rush orders etc.) with additional working hours or machine availability. The most effective use of the capacity buffer is given when you do not schedule your production lines to 100% (I have seen many times that lines are scheduled to be utilized 120%). Leaving free available capacity in the schedule, enables MTO orders to drop in and enables a relative short fulfillment of unplanned order quantities.

The best combination of the three buffers also fulfills the demand for a lean and agile supply chain. The MTS part therin provides the lean part in that it reduces waste whereas MTO gives you a lot of agility.

Tuesday, October 22, 2013

Capacity Planning! Or Scheduling? ::: Leveling? Maybe Sequencing?

Once your company has purchased SAP software, you have these great tools available which allow you to put a production program together in a very automated way. You could also check your long term plan for feasibility or play through some planning scenarios and 'what if's'.

The problem, however, is.... You can't use any of it! Because it never was configured and nobody ever showed you how to do or use it. During the implementation it was simply not in the cards to do Capacity... (anything). It might have been that it was considered a stage 2 project, the implementation consultant didn't really know how it works, it was considered non-essential for the business or someone said: "we have ample capacity and therefore don't need to worry about it".

Whatever the case may be, without planning, sequencing, leveling and scheduling orders and capacity, you're going to end up with half a process. To my great astonishment capacity planning is rarely used. As we all know the MRP run generates supply orders without any consideration of available capacity. It also does not care about a sequence or a leveled, noise-less schedule. It simply says:"I see demand and here are the orders that fulfill that demand", all stacked up on top of each other to the latest possible delivery date.

This is in no way a production schedule... no matter how much available capacity you have. You need to take the MRP run's result and plan, sequence, level and schedule the orders before you can effectively produce product in the right quantity at the right time.

So how can you do that in SAP? Four easy steps:

1. capacity planning: use basic data like lot sizing procedure, takt time and lead time scheduling to have the MRP run come up with an approximate plan. Check on you work center settings and shift schedule to make sure correct lead times are calculated.

2. capacity sequencing: use any one of the transactions CM21, CM25, LAS2 or MF50 (depending on whether you're process, discrete or repetitive) to employ a sequencing strategy like heijunka, first in - first out, priority, setup optimization or manual.

3. capacity leveling: ensure that the available capacity on the line is not exceeded. On a mixed model line or on a mixed strategy line (MTS and MTO) it is not good practice to schedule to 100% (or even above). Leave some room for variability.

4. capacity scheduling: now it's time to fix the schedule. But not before you check if the components are available. Very often orders are released to the line and then there are missing parts. This causes exorbitant lead times and blocking of capacity and material for other orders. Transaction MDVP is an excellent tool to check availability collectively (but do make sure you have the right rules in place). Then you can use COR8 to collectively convert plasnned orders into a feasible schedule that can be handed down to the shop floor. athere is still whiggle room but at least you have a plan now.

And most importantly: you now have something that you can measure against. Isn't that the most frustrating part about not employing Capacity Planning? The fact that you never know what actually should happen? and you never know that you have either done a good job or not?

what I don't understand is that we all put dentist appointments into our calendar, prioritize our social schedule, make sure we do not put more than 24 hours into a day and stick to promises we made before ... but only rarely do we do Capacity Planning, Sequencing, Leveling and Scheduling with SAP!

...and it's so much easier with SAP!

The problem, however, is.... You can't use any of it! Because it never was configured and nobody ever showed you how to do or use it. During the implementation it was simply not in the cards to do Capacity... (anything). It might have been that it was considered a stage 2 project, the implementation consultant didn't really know how it works, it was considered non-essential for the business or someone said: "we have ample capacity and therefore don't need to worry about it".

Whatever the case may be, without planning, sequencing, leveling and scheduling orders and capacity, you're going to end up with half a process. To my great astonishment capacity planning is rarely used. As we all know the MRP run generates supply orders without any consideration of available capacity. It also does not care about a sequence or a leveled, noise-less schedule. It simply says:"I see demand and here are the orders that fulfill that demand", all stacked up on top of each other to the latest possible delivery date.

This is in no way a production schedule... no matter how much available capacity you have. You need to take the MRP run's result and plan, sequence, level and schedule the orders before you can effectively produce product in the right quantity at the right time.

So how can you do that in SAP? Four easy steps:

1. capacity planning: use basic data like lot sizing procedure, takt time and lead time scheduling to have the MRP run come up with an approximate plan. Check on you work center settings and shift schedule to make sure correct lead times are calculated.

2. capacity sequencing: use any one of the transactions CM21, CM25, LAS2 or MF50 (depending on whether you're process, discrete or repetitive) to employ a sequencing strategy like heijunka, first in - first out, priority, setup optimization or manual.

3. capacity leveling: ensure that the available capacity on the line is not exceeded. On a mixed model line or on a mixed strategy line (MTS and MTO) it is not good practice to schedule to 100% (or even above). Leave some room for variability.

4. capacity scheduling: now it's time to fix the schedule. But not before you check if the components are available. Very often orders are released to the line and then there are missing parts. This causes exorbitant lead times and blocking of capacity and material for other orders. Transaction MDVP is an excellent tool to check availability collectively (but do make sure you have the right rules in place). Then you can use COR8 to collectively convert plasnned orders into a feasible schedule that can be handed down to the shop floor. athere is still whiggle room but at least you have a plan now.

And most importantly: you now have something that you can measure against. Isn't that the most frustrating part about not employing Capacity Planning? The fact that you never know what actually should happen? and you never know that you have either done a good job or not?

what I don't understand is that we all put dentist appointments into our calendar, prioritize our social schedule, make sure we do not put more than 24 hours into a day and stick to promises we made before ... but only rarely do we do Capacity Planning, Sequencing, Leveling and Scheduling with SAP!

...and it's so much easier with SAP!

Sunday, October 20, 2013

What the strategy group on MRP3 (and Policy Setting) can do for a leveled production schedule with agility.

Last week I got engaged with a client to work on a model, so they can perform effective materials planning. The client did great preparations in defining guidelines for policy setting in an ABC / XYZ matrix. This kind of thinking drives SAP software to support the achievement of targets and goals: Periodic policy setting based on changing situations is imperative, so that it automates ongoing balancing between service levels and optimized inventories.

One part of the solution was dealing with production scheduling. The question at hand: how do we level the production program MTS (X and Y items) and let MTO (Z items) orders flow in ?

The answer: use different policies to drive automation for different situations. Below you can see the grid we came up with.

The idea behind setting policies in the various classes is to determine an ideal mix of production quantities. This in turn drives great service levels and minimum inventory holdings, even though variability causes a deviation of actual order quantities and dates from the forecast...

For all X items we assume a high forecast accuracy (90 to 95%), and therefore a Make To Stock strategy is applied in order to manufacture finished product to a forecast into inventory. Because of the high degree of predictability, we can assume that any forecast error can be covered with safety stock. That is why we want to use strategy 10 which creates an LSF requirements type. LSF requirements do not consume itself against customer orders and therefore additional, actual demand must be covered by safety stock. This should be in order, since the forecast error is minimal for X items.

as for safety stocks our policies suggest to use a dynamic safety with a coverage profile. This is because the dynamic safety stock goes up and down with future, forecasted demand and would therefore adjust itself up and down for important A items. For less important B items we would use an automatically calculated static safety stock, whereas we would use a static safety stock manually for the least valuable C items.

For Y items there is slightly more variability and the forecast does not necessarily provide as much comfort as it does for X items. That is why our policy calls for strategy 40 and the associated requirements type VSF. A VSF is consumed by incoming customer orders and therefore - if actual customer orders exceed the forecast - additional demand is directly transferred into the production program. In this case we do not need a safety stock, since we satisfy demand over and above the forecast, directly from production.

A fixed lot size is used, so that the MRP run generates supply in fixed quantities, which a scheduling system can level, sequence and distribute within available capacity on the line. The production program for XA products is generated weekly wheras for XB and XC products the program is created bi-weekly and monthly respectively. This is due to the fact that A items need more attention and need to be checked more frequently, due to their nature of being of high consumption value.

Z items are set up to be Made to Order. However, there is a forecast placed on the finished good, so that it is possible to procure raw materials and reserve capacity on the lines. This is achieved using strategy 52, which generates a VSE requirements with statistical planned orders which reserve capacity and allow the transfer of requirements to raw materials. Z items do not have safety stocks and a production program is not necessary, since actual orders flow into the free capacity spots that were reserved.

In this sense it is possible to generate a level production plan considering all products running on the 'mixed model lines'. Class A materials build the basis with a weekly, undisturbed schedule of fixed order quantities that build inventory to the forecast plus a safety stock. Class B materials are then stacked on top, using about 30% of the capacity (for an approximate total of A and B items of 80%). Orders exceeding the forecast will be placed into the bi-weekly production program and reduce the remaining available capacity for C products.

This kind of thinking is nothing new, but unfortunately it's not applied very often. In many cases, people think that MRP should generate the production program directly. That is not how it works in an MRP type planning system. MRP will generate supply based on your basic data setup, but under no consideration of available capacity on the lines. MRP also does not create a sequence of orders and it does not fix the schedule. Because of that, you should introduce that extra step in between the MRP run and handing over a schedule to production: Sequencing, Leveling and Scheduling !

One part of the solution was dealing with production scheduling. The question at hand: how do we level the production program MTS (X and Y items) and let MTO (Z items) orders flow in ?

The answer: use different policies to drive automation for different situations. Below you can see the grid we came up with.

The idea behind setting policies in the various classes is to determine an ideal mix of production quantities. This in turn drives great service levels and minimum inventory holdings, even though variability causes a deviation of actual order quantities and dates from the forecast...

For all X items we assume a high forecast accuracy (90 to 95%), and therefore a Make To Stock strategy is applied in order to manufacture finished product to a forecast into inventory. Because of the high degree of predictability, we can assume that any forecast error can be covered with safety stock. That is why we want to use strategy 10 which creates an LSF requirements type. LSF requirements do not consume itself against customer orders and therefore additional, actual demand must be covered by safety stock. This should be in order, since the forecast error is minimal for X items.

as for safety stocks our policies suggest to use a dynamic safety with a coverage profile. This is because the dynamic safety stock goes up and down with future, forecasted demand and would therefore adjust itself up and down for important A items. For less important B items we would use an automatically calculated static safety stock, whereas we would use a static safety stock manually for the least valuable C items.

For Y items there is slightly more variability and the forecast does not necessarily provide as much comfort as it does for X items. That is why our policy calls for strategy 40 and the associated requirements type VSF. A VSF is consumed by incoming customer orders and therefore - if actual customer orders exceed the forecast - additional demand is directly transferred into the production program. In this case we do not need a safety stock, since we satisfy demand over and above the forecast, directly from production.

A fixed lot size is used, so that the MRP run generates supply in fixed quantities, which a scheduling system can level, sequence and distribute within available capacity on the line. The production program for XA products is generated weekly wheras for XB and XC products the program is created bi-weekly and monthly respectively. This is due to the fact that A items need more attention and need to be checked more frequently, due to their nature of being of high consumption value.

Z items are set up to be Made to Order. However, there is a forecast placed on the finished good, so that it is possible to procure raw materials and reserve capacity on the lines. This is achieved using strategy 52, which generates a VSE requirements with statistical planned orders which reserve capacity and allow the transfer of requirements to raw materials. Z items do not have safety stocks and a production program is not necessary, since actual orders flow into the free capacity spots that were reserved.